There are a three reasons behind my becoming The Geospatial Investor:

-

- Keith Gill

- Kenneth Marshall

- Jack and Laura Dangermond

Let me explain one by one.

Keith Gill

Keith Gill was responsible for the frenzy around Gamestop shares in 2020-21. He is a chartered financial analyst (CFA) who bought ~$USD50K in call options (something you should never do as an amateur) on Gamestop due to the market giving it a lower value than it was truly worth. He is also an incredibly decent guy with a terrifically enthusiastic attitude, great sense of humour, passion for educating others and he is a fighter. At the peak of the frenzy, his call options were worth about $USD50M. For this, he was hunted by journalists and summoned to a hearing of the U.S. House of Representatives Committee on Financial Services. The greatest thing of all? He managed to slip in the comment “I am not a cat” during his testimony, a reference to his Youtube channel called The Roaring Kitty. Why am I starting off with Keith Gill? Well, look at him. He is undeniably an inspiration, and was such a decent chap throughout it all, even showing great composure and a sense of humour when grilled by Congress. And that CFA of his doesn’t come easily. For example, the latest pass rate for those taking the Level 1 exam was only 38%! This is why he’s on our list. Rigour, intellect, grit, enthusiasm, humour and boldness.

Kenneth Marshall

Kenneth Marshall is also a securities analyst. Whilst Keith’s CFA is nothing to be sniffed at, Kenneth has a Harvard MBA and teaches investing, personal finance and industry analysis courses at Stanford, Berkeley and the Stockholm School of Economics. I’ve never met the guy in person, nor lived or studied in the US or Sweden, so why is he one of the reasons behind my becoming a geospatial investor? I took his introductory value investing course online through Stanford Continuing Studies at the beginning of 2019. This has opened up a new world for me. Have you ever wondered how Trimble is doing as a business? Sure, their positioning devices might be on every tractor in every field but are they making enough money for it to be worth it? Now that I have done the course, this is easy to gain a sense of, as described next.

Trimble’s latest annual report shows operating income (see the income statement on p. 47) has compounded at 14.3% annually from $USD376M in 2019 to $561 last year (2021). We need to consider this, however, in the context of the number of fully diluted shares. We are shareholders. Imagine if the number of shares doubled between 2019 and last year. This means the income is spread across twice as many shares. If income stayed the same over that period, effectively, for us shareholders, the income in fact halved due to the extra shares. So let’s do this growth calculation again. This time we factor in the number of fully diluted shares (underlined in the following formula) for 2019 and 2021: (((561/254.3)/(375.9/252.9))^(1/3))-1=14.1%. The growth rate is marginally less, given that 254.3-252.9=1.4M extra fully diluted shares were issued between 2019 and 2021. Regardless, the growth rate handily beats inflation, even at its current, elevated levels. Let’s now check another metric that is important to securities analysts, return on capital employed (ROCE).

Using numbers from Trimble’s balance sheet on p. 46, capital employed last year was 7,099.6-207.3-231.0-548.8=6112.5. That is, total assets minus non-interest bearing current liabilities (in this case, accounts payable, accrued compensation and benefits, and deferred revenue). We can gain a sense of whether they’re making enough money for it to be worth it by calculating the return on the capital that they are employing. The return is operating income. We already have both of those numbers. Recall from the previous paragraph we know they made 561M in operating income last year, and we just calculated a capital employed figure of 6,112.5M. Expressing operating income as a percentage of capital employed gives us the return: 561/6112.5=9%. Right away I know they are not doing very well. I will discuss why next.

The US market as a whole achieves an ROCE of about 10%. Assume you are an entrepreneur. At a very basic level, what you do is park some money in something called a business. In exchange for tying up that money, you expect to get money back. Of course, the less money you have to park, the better. An ROCE of 9% says you have to park (or employ capital of) $100 to get (as operating income) $9 every year. But an ROCE of 10% says you have to park only $90 to get the same $9 every year. So Trimble is not looking like a decent option compared to the market. We need to keep looking for something that returns more than the market. For example, if we had a business with a 20% ROCE, then we only have to park $45 and we still get our desired $9 annual return. Now we’d be doing really well! We can put the remaining $55 into other businesses or, you know, enjoy life a little by spending it. I know, I’d buy a used, $50 Trimble 5700 series battery on eBay!

Now you know how to see more in the world than just its products. You can understand, using arithmetic that is far easier than anything you had to learn for geostatistics exams, whether or not those products translate into a worthwhile business. It’s fascinating. Some brands that you thought were amazing can suddenly start to look different once you look at them in terms of income. You can even try it on Autodesk or Nearmap.

Jack and Laura Dangermond

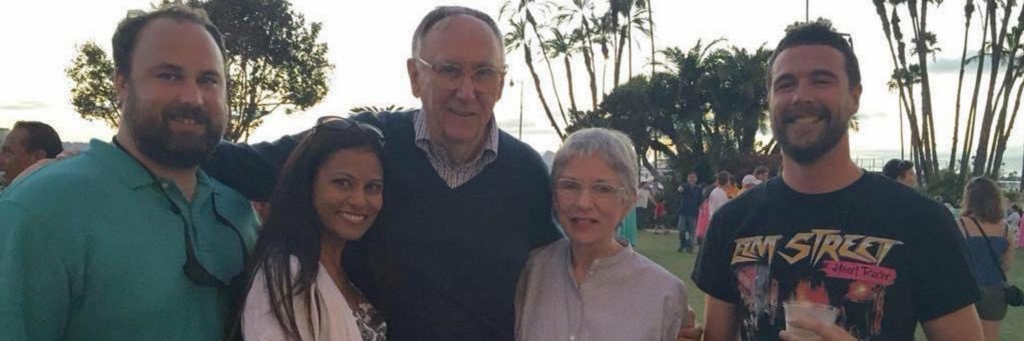

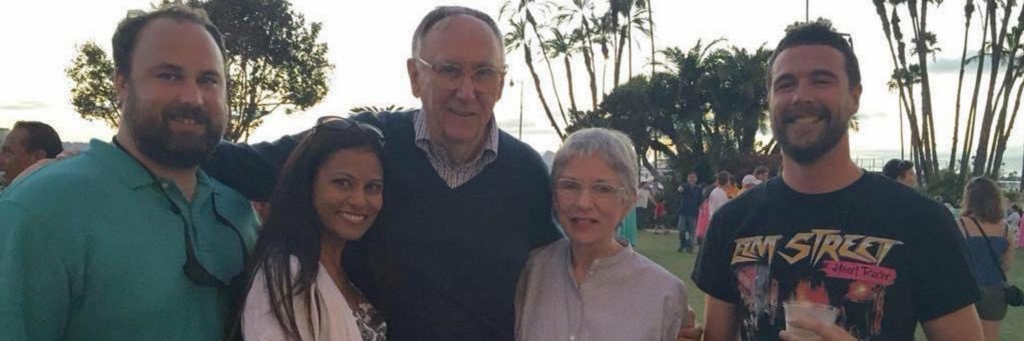

Ok, so let’s start talking about people you might actually know. Here is a photo of them in the middle plus two colleagues of mine and I in 2015:

This is the OG GIS power couple – Jack Dangermond, and no his wife isn’t called Jill, she’s called Laura. As far as I know, these are the only billionaires I’ve ever had a photo with. It’s quite fitting as they’re the founders of Esri who hold about 45% geospatial market share. It was at the annual Esri User Conference in San Diego, they were just walking through the concert crowd on the final day. Anyway, why am I mentioning them on the list of people that inspired me to become a geospatial investor? Apart from, you know, being billionaires? It’s again about income growth, this time for Esri. This is harder to gauge as Esri is a private company but I know people in low places can use Wikipedia. This shows a Way Back Machine snapshot of an Esri webpage touting their 1997 $USD244M annual revenue. Roll forward to now, and the best I can come up with is Auren Hoffman’s interview with Jack where revenue of $1.3B is mentioned. The interview was in 2021, so this is a 25 year period we are looking at. Over such a time period, inflation matters so we’ll have to adjust the 1997 number to $451 using the US Bureau of Labor Statistics CPI Inflation Calculator. Right, so now we calculate the compound annual growth rate of 451 to 1300 over 25 years: (((1.3)/(0.451))^(1/25))-1=4.3%. This is interesting because it can now be compared to one’s own income growth rate!

Income Growth Rate

Why does it matter comparing one’s own income growth rate with that of Esri, monopolist of the geospatial industry? Wouldn’t it be nice to feel that, as a humble little worker bee, you were getting ahead at the same rate as them? How would you feel if the monopolist was outdoing you in growing their income? So go on, get the government inflation calculator for the currency of your first salary, make the necessary adjustment then calculate the compound annual growth rate between that and what you earn now. I hope I haven’t caused you any sadness with this calculation!

My response to this calculation is that my income growth rate serves as motivation to be a great investor. I want to boost my current income by 50%. 1/3 of my income is disposable. I need to multiply that by 2.5 in order to generate a 50% income boost. Whilst not as amazing as Keith Gill’s 1000x gain on Gamestop, it is still a very, very tall order. I will need to turn myself into the best investor the geospatial industry has ever seen.

I’m going to give this a try. Honestly, a 250% annual return will be impossible at my current skill level. Nevertheless, I am in the right city (outside of the US) to attempt something like this. The city where I live is Europe’s biggest by GDP. It is known for tech start ups and there are fantastic universities here turning out amazing talent. This country also offers tax-free investment accounts so that’s a quick gain right there! It is time to integrate the rigorous training I’ve had as an equities analyst with the intuitions I’ve gained over 12 years as a geospatial consultant. You never know, I might even bring myself to commit the cardinal sin of buying call options.

What’s next then? You have a lot of rich (pardon the pun) content coming up! I’m proud of what I’ve managed to discover about geospatial equities so far. Can I tempt you with a nearly 50% compounding rate for The Geospatial Index? Thought so.

Until next time,

The Geospatial ?nvestor