Progress Update

It has been a productive 4 months since I last wrote in September. I have been very busy. In that time I have assembled this watchlist. This was a project I began in August last year. It became an obsession for me. I stayed up until 2am twice, a couple of times till 1 (including now writing this!), and once until 5:30am. The latter was when I manually adjusted all 100+ positions for stock splits. Splits can get crazy. I believe most of the work finding businesses to add to it is done though.

Categorising the list

The list contains 144 pure play and adjacent geospatial companies, globally. I classify them as pure play if they are geospatial, navigation, CAD, surveying, earth observation etc companies. They might sell services, products or equipment. An example is Maxar. This started its public equity life on the Toronto Stock Exchange as MacDonald Dettwiler on 2000-07-12. The initial price was $CAD14, it is now 69. It has compounded at 7% annually since then. If you purchased $100 in shares at the IPO, it’s now worth ~450. You would have beaten the S&P 500 Index by 2%. A very large amount over generations of compounding.

There are many non pure-play firms making very strong impacts though, such as Google. I classify this as a company adjacent to our industry. For example, their Google Maps product is one of the most installed apps of all time and the most popular navigation app by far. The industry, and the quality of life improvements caused by it, would be less without Google’s geospatial products and services. Therefore, such companies appear in The Geospatial Index.

It would also involve significant financial loss not to include such companies. Google has been in the Index since its 2004 IPO because that is also the year they bought Keyhole. This would become Google Earth in 2005, along with a release of Google Maps the same year. Since IPO to now it has compounded at 20% annually. $100 of stock is now worth 2700.

Survivorship Bias

So, what is the performance of this as a fund? This is difficult to assess due to survivorship bias. This is a common problem when doing so-called back testing. You shouldn’t make conclusions about performance based just on the companies trading now. This is because what’s missing are the majority of companies: those that never made it. There are many permutations actually.

For example, another way a company could disappear from an exchange is through being acquired. Consider Mobileye. It went public, then got acquired by Intel, then got spun off last year as something individually tradable again. Business is complicated. Cardno is no longer traded, shareholders have had their capital returned after it was acquired.

An expression of these types of outcomes is the 17 sell trades in the portfolio. An example of a sell was McDonalds after they sold Quintillian, the store location mapping software they developed in house. Another was Pitney Bowes after they sold MapInfo. But I also have MapInfo in there for the period it was a public company, it no longer is. This is all really hard work.

Because all of this is so complicated, it is costly to purchase datasets of the trading history of all companies, including the ones no longer in existence. I don’t have the money for this. Intrinio has been in touch on Twitter offering a free trial but I haven’t heard anything more. I am, however, building a network that helps. For example, whilst attending Geomob Barcelona I met Rafael Roset. He is 2 from my right:

He is a senior geospatial professional in the city. He was kind enough to tell me about Telcontar, acquired by DeCarta, subsequently acquired by Uber. The way it usually goes is I then see if I can find any history of all participating firms being publicly traded at any point, and have that history in the index. I am unable to find any of those. The same issue has occurred for ESL Incorporated and TRW Inc (which subsequently acquired it).

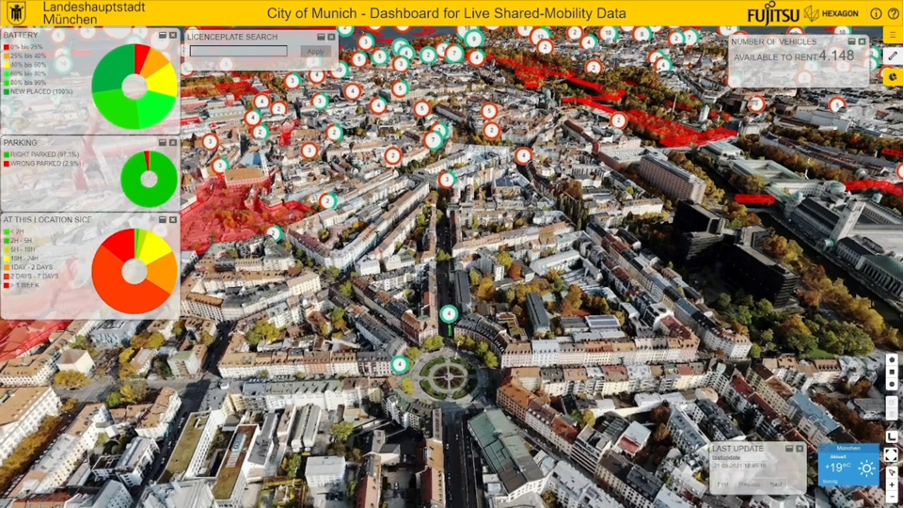

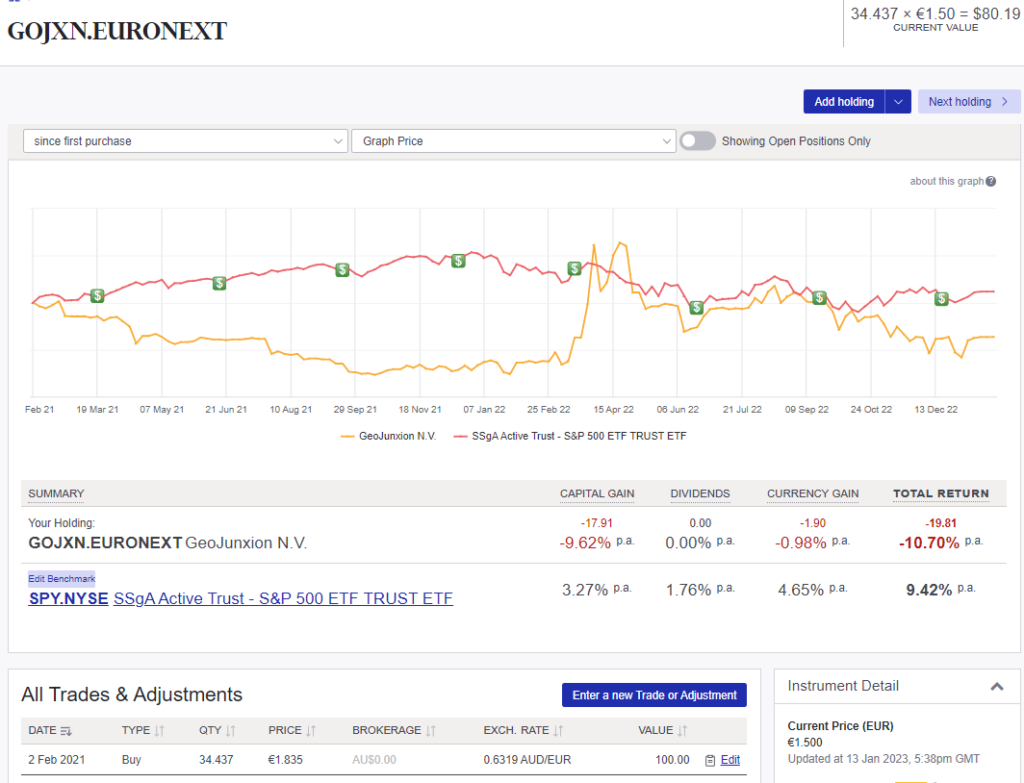

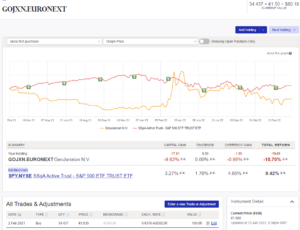

Raf also nominated a Dutch geospatial firm called GeoJunxion:

I was able to add this one as it is still traded today. You can see they have not performed well now that the COVID stock market mania is over.

So, yes, I admit I am withholding from you the performance of the index so far. I think I have a misleading impression of the market more than 10 years ago. There are still many good things it has done, however, for me as a professional. It is a great way to stay abreast of developments in our industry. Knowing that each relates to a stock you can trade makes it even more meaningful in my view.

Benefit of Never Selling

Other things to note about the Index is that it is equal weighted: $AUD100 per position. Additionally, the aim is to never sell. The only reason to sell is if, like MacDonald’s selling Quintillian, the company no longer has a geospatial impact on the world. Or if it goes bankrupt etc. A well known investor, Ian Cassel, comments that the practice of never selling sets you up to reap incredible returns through capturing the runaway gains of a few big winners. Kenneth Langone’s experience with Eli Lilly was similar. Chuck Akre says the same.

I will say this much. The Index has dropped only 4% in the past year, whereas the market has dropped 10%!

Sources

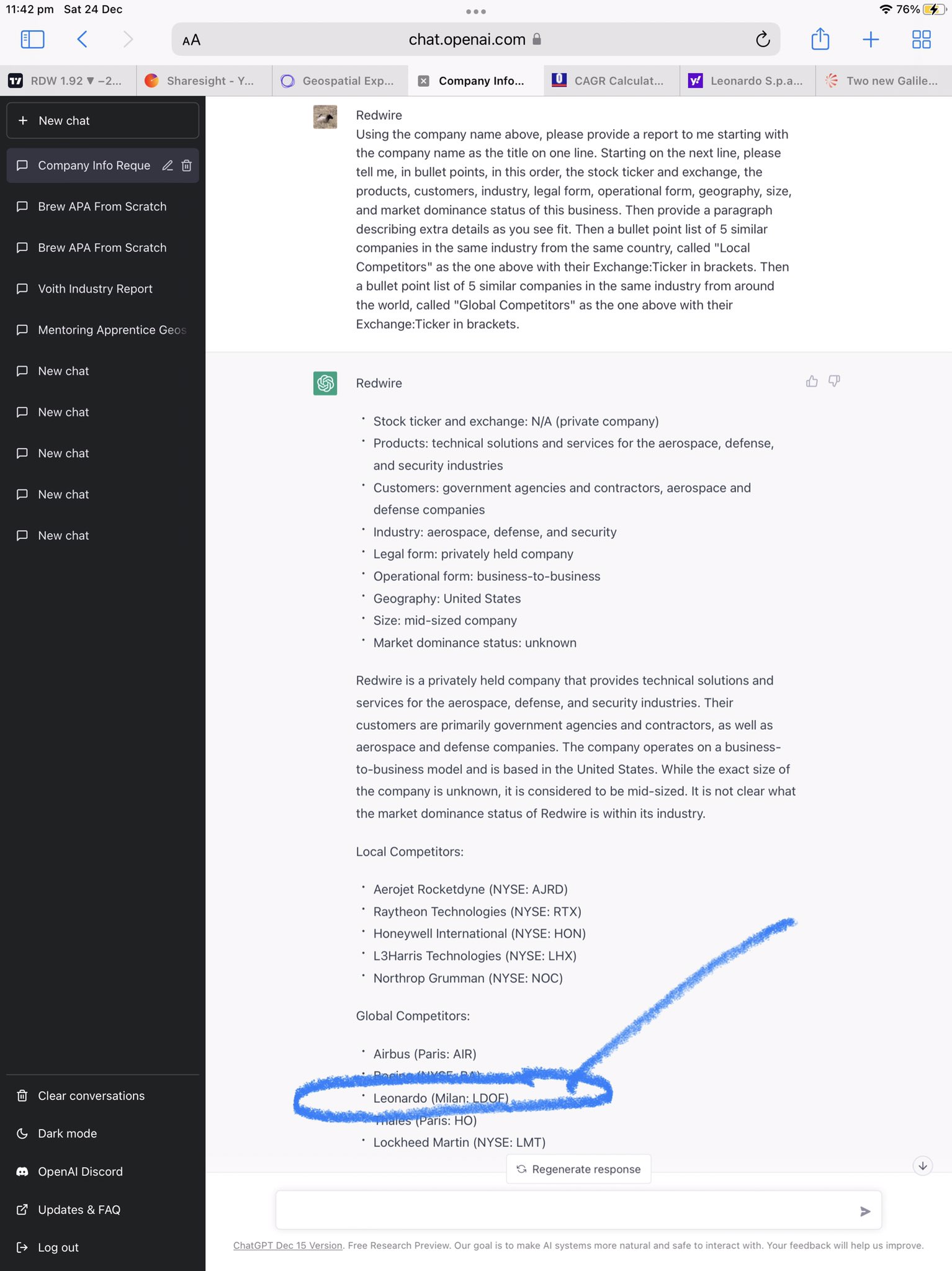

Of course, in the process of building out the Index, I learnt to harness ChatGPT. I gradually engineered the following prompt:

<EXCHANGE:TICKER> (e.g. NYSE:UBER)

Using the company name above, please provide a report to me starting with the company name as the title on one line. Starting on the next line, please tell me, in bullet points, in this order, the stock ticker and exchange, the products, customers, industry, legal form, operational form, geography, size, and market dominance status of this business. Then provide a paragraph describing extra details as you see fit. Then a bullet point list of 5 similar companies in the same industry from the same country, called “Local Competitors” as the one above with their Exchange:Ticker in brackets. Then a bullet point list of 5 similar companies in the same industry from around the world, called “Global Competitors” as the one above with their Exchange:Ticker in brackets.

The results were always interesting. Circled below is Leonardo, a new firm for the index, adjacent to geospatial.

I have found out about companies all over the world, including the US and China, through using ChatGPT in this way.

Other sources of information to build the list:

List of GIS Companies in the World: The Best List You’ve Been Looking For

This Google search.

https://www.appgeo.com/top-satellite-and-aerial-imagery-companies/

This article.

This map.

Even GitHub had something.

This article on spatial computing.

Infographics from @terrawatchspace in 2022 about all things Earth observation👇

1. An overview of the commercial market landscape of EO for climate – segmented into data, solutions, and applications.

Expect more deep dives on EO for various climate applications in 2023 🌍🛰️ pic.twitter.com/AC0i2rPT8L

— Aravind 🌍 🛰 (@aravindEO) December 27, 2022

This article about LiDAR stock carnage.

This, and practically any article from the glorious and righteous Joe Morrison.

This splendid history from Joe Francica.

Continued in Part 2.

A silly sounding site called Datarade was surprisingly useful.

Even the Connect algorithm on Twitter!

I tried everything, even EDGAR’s autocomplete function in company search.

Not to mention plugging every geospatial, navigation, surveying, satellite etc term I could think of into Tradingview’s search function… this was surprisingly useful even for finding firms in China.

Regarding Indian firms, none other than Ujaval Ghandi of Spatial Thoughts helped me out!

An unexpected but amazing resource came from a cryptocurrency project, of all things, Golden. I used it to find an absolute plethora of GEOINT firms. It was at that moment that I realised I have missed the entire geospatial industry, basically, in my career. This is because the biggest geospatial business deals (some of them in the billions) are done by defence companies. I have never worked in defence and probably never will. But some of the products are holo-desk level. I have done some pretty cool things in some of the world’s worst places, but nothing will compare to Saab’s Sandbox.

Next Steps

Maybe this article from Bloomberg best sums things up. The geospatial industry is projected to grow north of a trillion in value by 2031 at a compound annual growth rate of 13%. This is far above the century plus average growth rate in the US and Australian markets of 6.5% after inflation. A basic way to take advantage is the equal weighted index approach I am demonstrating here. After that, you can start to refine things by avoiding companies that are in debt and also those that aren’t generating free cash flows. Another refinement is to wait 6 months to buy after an IPO. They typically drop dramatically. Just look at Innoviz. I will step through an analytical framework to identify such a company next.