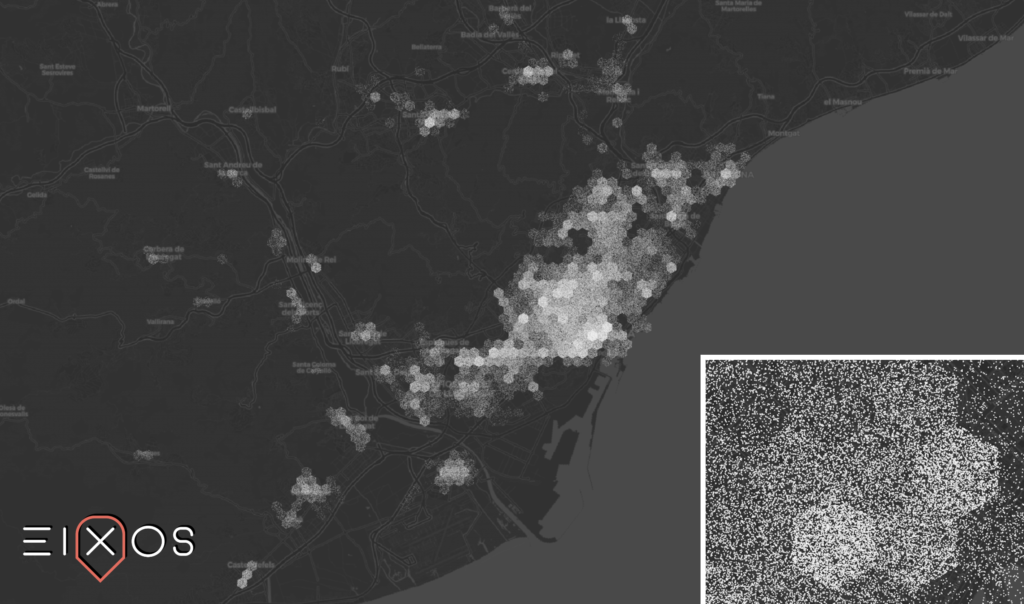

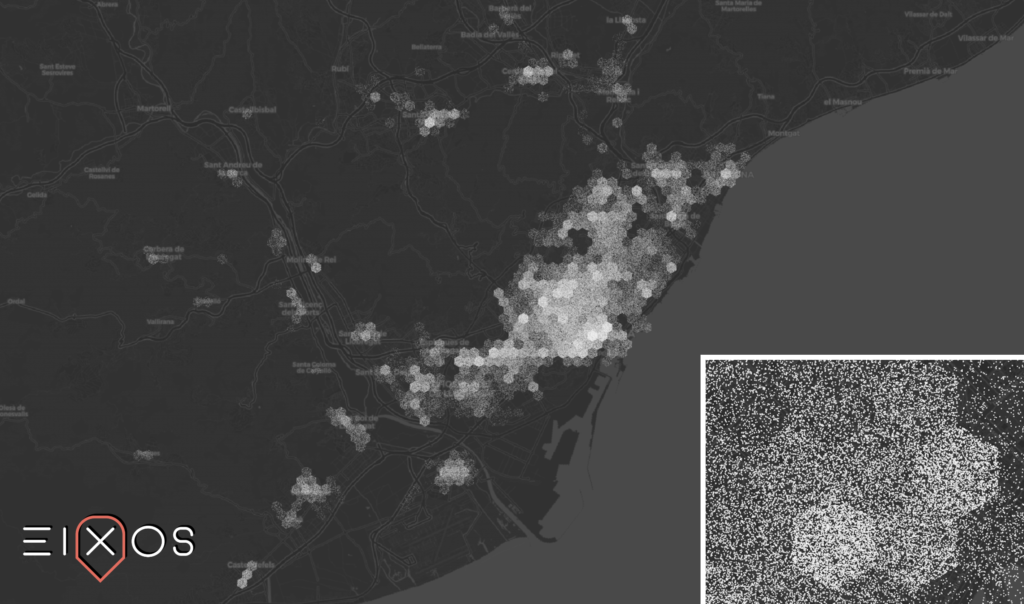

Business closure map

What would be the economic impact of covid19 on Catalan retail and commercial services? What should be the Spanish government minimum aids to the Catalan small business sector? This report gives an estimate to both questions.

According to our calculations, up to 40% of Catalan retail and commercial services could close permanently as a result of the impact of the COVID19.

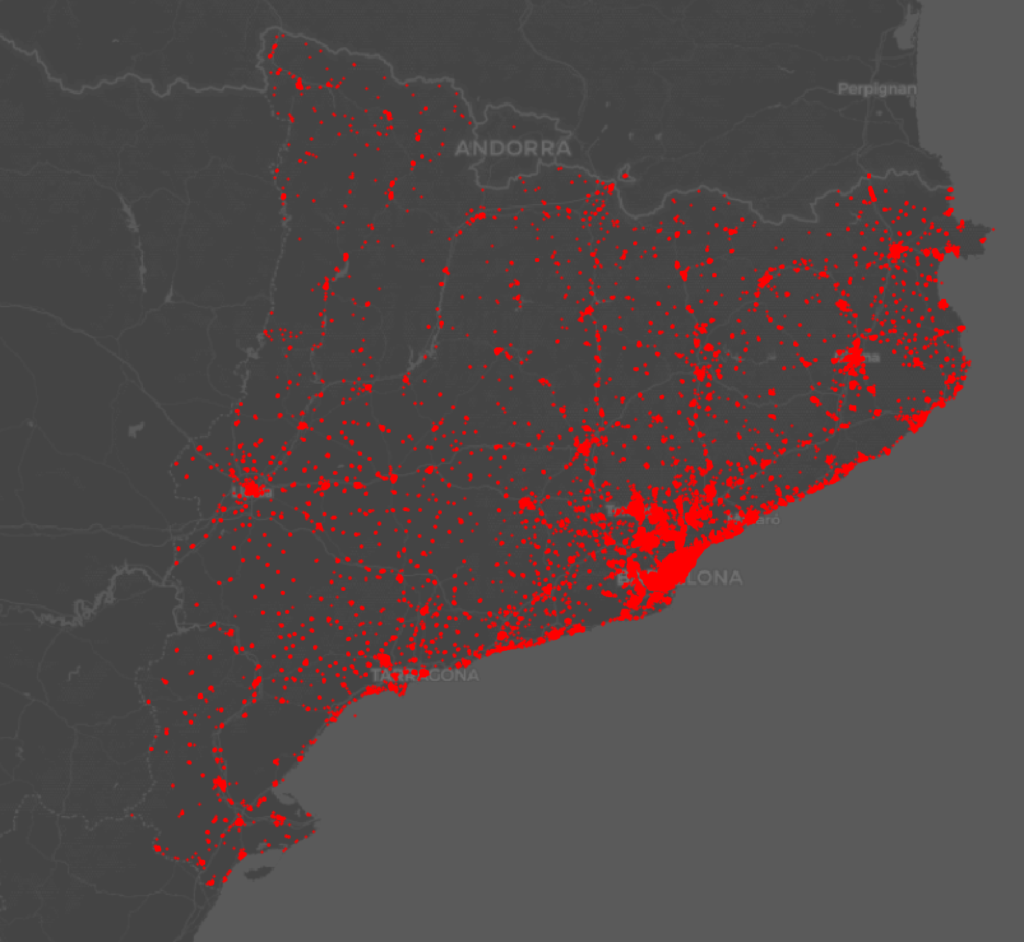

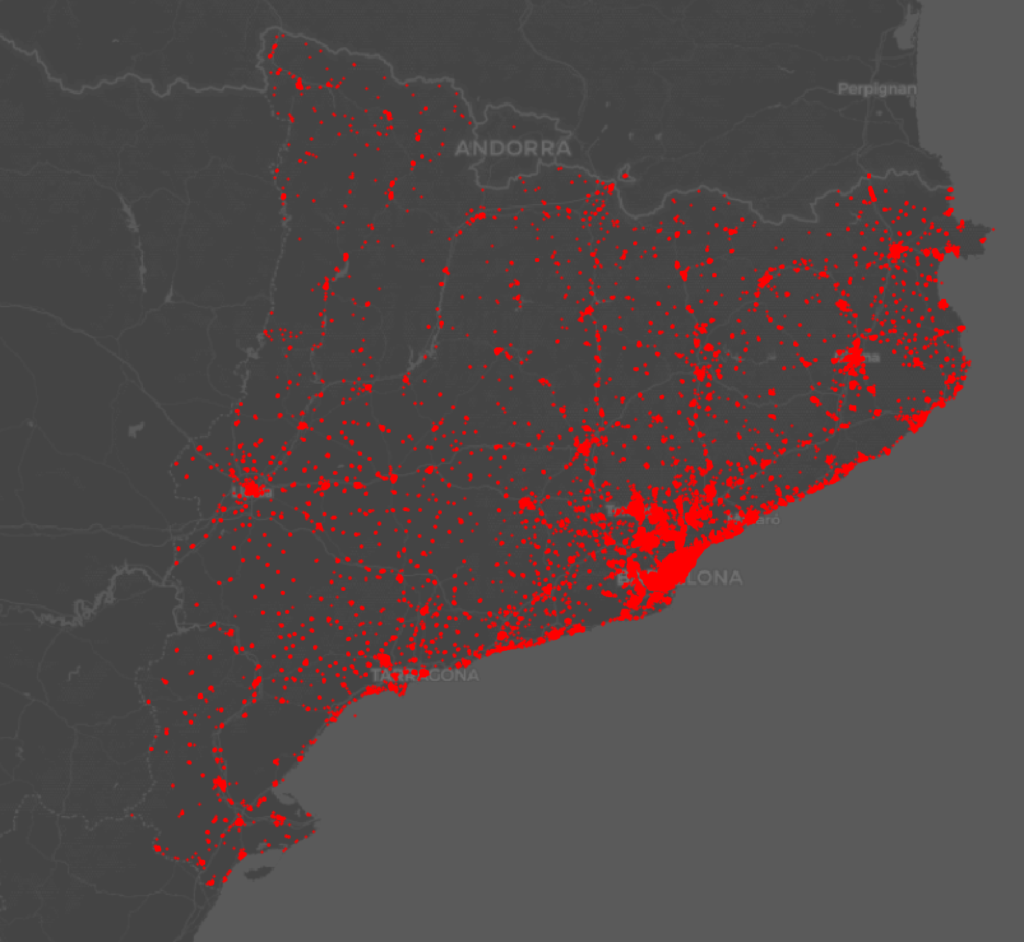

Eixos.cat carried out a retail stores & commercial services mapping months before the pandemic. According to this census, in Catalonia there were more than 125,000 active establishments and near 30,000 closed or vacant premises.

Map of retail stores, hotels & restaurants in Catalonia at the end of 2019. Each red dot represents a commercial premises, active or closed.

These 125,000 businesses directly employed directly more than half a million workers (526,527 according to Eixos.cat calculations).

With a retail occupancy close to 80% (IATC 77.39), Catalonia showed a scenario of relatively good commercial health. Below 70% occupancy is the critical threshold where commercial desertification starts.

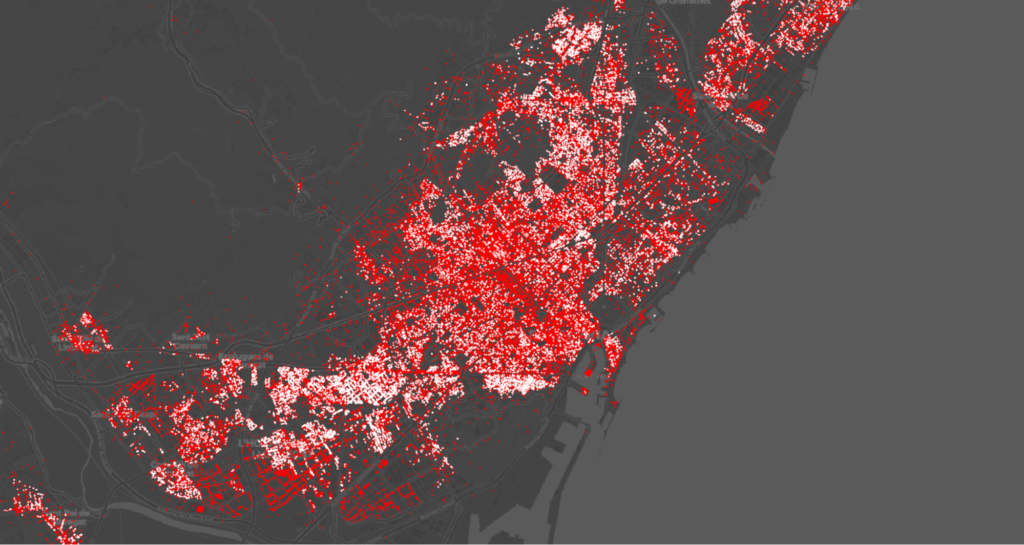

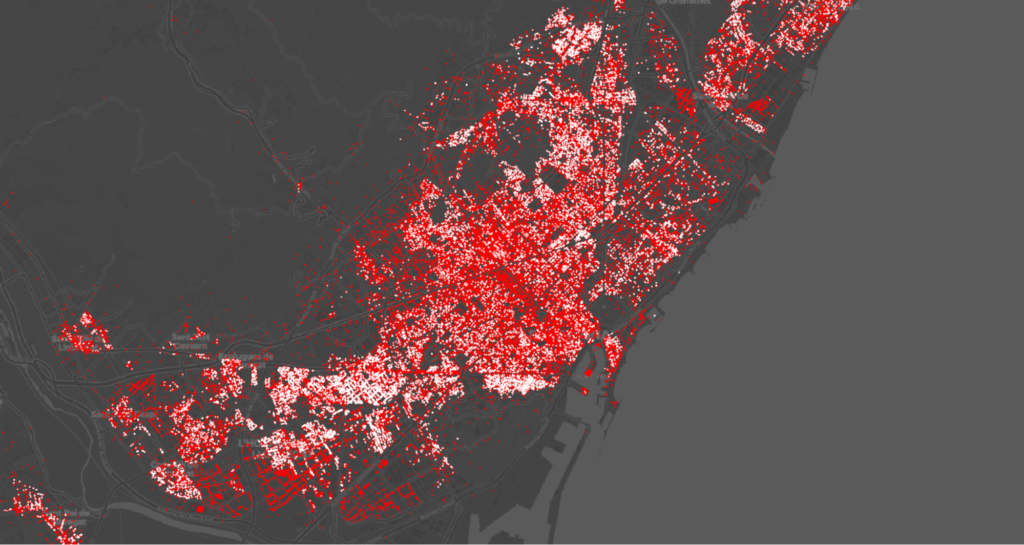

During the period of confinement only 15% of Catalan retail stores were essential and could open. The essential businesses that were within the shopping centers also had to stop activity. This meant a temporary closure of almost 90% of all businesses.

The post-lockdown reopening hasn’t been complete. Thus, there were many capacity restrictions and time limitations for at least 50% of the businesses.

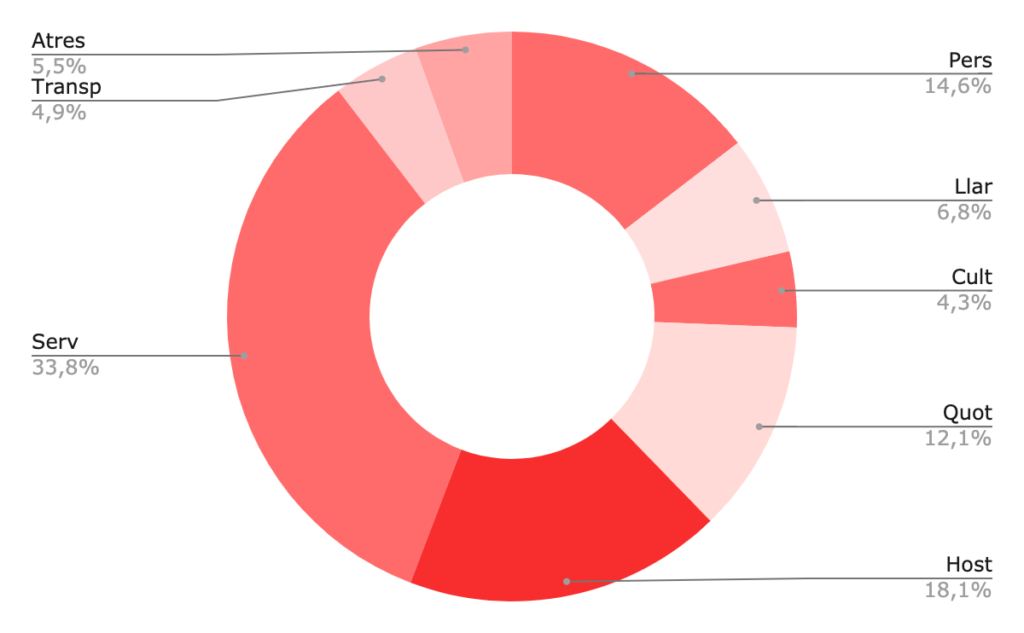

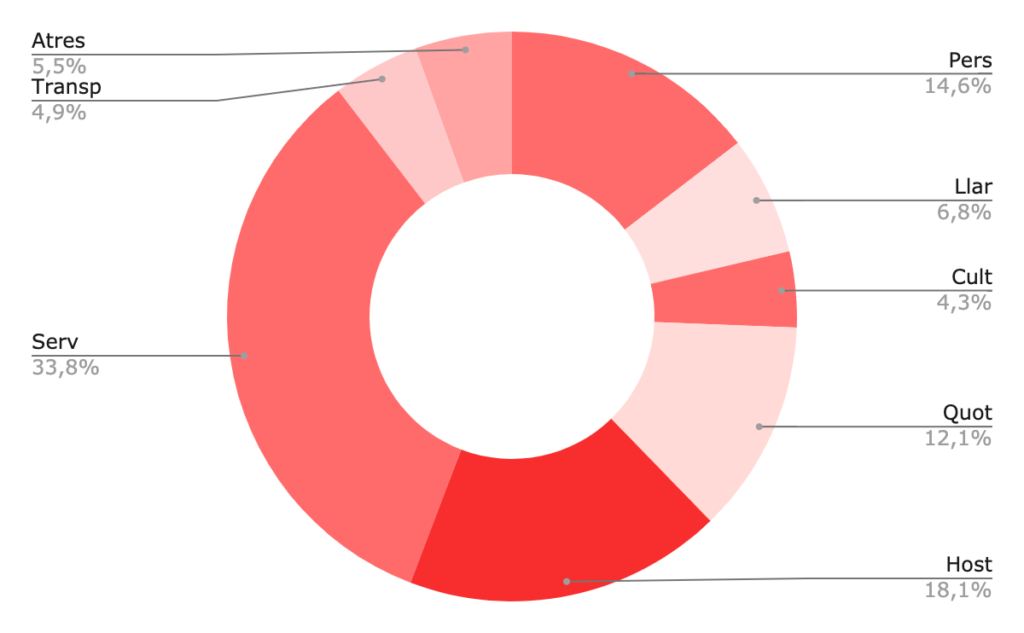

Hotel & restaurant (18.1%), apparel (14.6%), culture and leisure services (4.3%) and all businesses installed in shopping centers opened with severe limitations.

Map of essential and non-essential businesses in Barcelona and its surroundings. White dots, essential businesses. Red dots, not essential.

Business closure risk

These are the main conclusions of the report carried out by Eixos.cat, based on applying the EIXOS / MIT model for evaluating the risk of businesses closure due to the impact of covid19.

The application of confinement and social distancing measures to stop the pandemic, and the contagion risk perception by users, has direct consequences on the businesses closure.

The risk factor is applied differently on each commercial category, and is translated as a closure probability percentage. Thus, catering is the activity with the highest risk of closure (between 45% and 65%). Pharmacies and daily food are activities with a lower risk (between 6% and 26%).

| Category |

Low impact |

High impact |

| Hotel & Restaurant |

45% |

65% |

| Commercial services |

26% |

46% |

| Apparel |

15% |

35% |

| Others |

15% |

35% |

| Culture & Leisure |

9% |

29% |

| Daily food |

6% |

26% |

| Private vehicle services |

3% |

23% |

| Household |

5% |

18% |

Table with the estimate of the risk of closure of establishments for each commercial category.

Chart of the Catalan business sectors. The intensity of red indicates the risk of closure associated with the sector.

The impact of business closure on unemployment

In order to assess the economic impact of covid19 on Catalan retail & commercial services, we’ve also considered the impact of business closure on unemployment.

To estimate the number of workers directly employed by retail & commercial services, we have used a different methodology than the usual one.

The normal approach consists on deriving the number of workers from Social Security data. This data is impossible to disaggregate by retail stores, so it makes any calculation based on that a very gross approximation. For instance, it makes impossible to attach a self-employed or a salaried worker to a specific retail store. Among other things because, from the fiscal data available to the public administration, it is impossible to obtain a detailed map of the retail stores in the territory.

Map of retail & commercial workers in the metropolitan area of Barcelona. Each white dot represents a worker.

The calculation methodology that we propose does exactly the opposite. For start, it is based on a very precise retail geographic map, made by visiting, classifying and geolocating every single retail store & commercial service all over Catalonia. Once having this map, we make an estimate of the number of workers based on the surface area in m² and the type of economic activity of each business. So it’s a bottom-up method.

Thus, a restaurant would have, on average, up to 6 workers for every 100 m² of establishment. A car dealership, on the other hand, would have only 2 for every 100 m².

We detail these coefficients in the following table:

| Category |

Workers / 100 m² |

| Apparel |

5 |

| Household |

2 |

| Culture & Leisure |

1 |

| Daily food |

3 |

| Hotel & Restaurant |

6 |

| Commercial services |

5 |

| Private vehicle services |

2 |

| Others |

2 |

Table of relation of the number of workers per 100m2 of activity.

To simplify the calculations, we have assumed that the average size of all retail stores in Catalonia is 100m². In reality, the average size that appears to us in many of the cadastral calculations that we usually do in Eixos.cat is somewhat higher, around 120m². But we consider that the premises have storage spaces, toilets and some other dead space, where the activity is not properly developed so there’re not workers at all.

| Category |

Business |

Low impact |

High impact |

| Apparel |

18,038 |

15,332 |

11,725 |

| Household |

8,372 |

7,953 |

6,865 |

| Culture & Leisure |

5,321 |

4,842 |

3,778 |

| Daily food |

15,007 |

14,107 |

11,105 |

| Hotel & Restaurant |

22,373 |

12,305 |

7,831 |

| Commercial services |

41,835 |

30,958 |

22,591 |

| Private vehicle services |

6,102 |

5,919 |

4,699 |

| Others |

6,817 |

5,794 |

4,431 |

| Total |

123,865 |

97,211 |

73,024 |

Table of the variation of the number of establishments for each commercial category according to the EIXOS / MIT model for two impact hypotheses: low and high.

| Category |

Workers |

Low impact |

High impact |

| Apparel |

90,190 |

76,662 |

58,624 |

| Household |

16,744 |

15,907 |

13,730 |

| Culture & Leisure |

5,321 |

4,842 |

3,778 |

| Daily food |

45,021 |

42,320 |

33,316 |

| Hotel & Restaurant |

134,238 |

73,831 |

46,983 |

| Commercial services |

209,175 |

154,790 |

112,955 |

| Private vehicle services |

12,204 |

11,838 |

9,397 |

| Others |

13,634 |

11,589 |

8,862 |

| Total |

526,527 |

391,777 |

287,644 |

Table of the variation of the number of workers for each commercial category according to the EIXOS / MIT model for two impact hypotheses: low and high.

According to the employment data published by the Statistical Institute of Catalonia (Idescat), in Catalonia in the last quarter of 2020 there were about 3,4 M workers. Of these, 2,5 M workers were in the Services category, which is the one that includes retail and commercial services (also hotels & restaurants).

The long half million workers in commerce and hospitality represent almost 16% of the total mass of Catalan workers, and 21% of workers in the Services category.

|

4T 2020 |

Low impact |

High impact |

| Employment (Idescat) |

3,340,600 |

3,205,850 |

3,101,717 |

| Retail & services workers |

526,527 |

391,777 |

287,644 |

| Retail & services workers (%) |

15.76% |

12.22% |

9.27% |

| Employment variation |

|

-134,750 |

-238,883 |

| Employment variation (%) |

|

-4.03% |

-7.15% |

Is it a lot or a little? Comparison with the 2008 crisis

According to Idescat, during the 2008 great economic crisis, the occupation fell from 3.58 M to 3.29 in just one year. A total drop of 8%, as the sum of all sectors.

Based on the data in this report, we can say that the fall in Catalan employment coming from only one of the sectors, retail and commercial services, which Idescat includes within the “Services” catch-all, by itself, it would already account for 7.15% of the total fall in employment in Catalonia.

In other words, in terms of all Catalan employment, the loss of jobs as a result of the closure of shops, bars and restaurants, would already account for almost 90% of the total loss of employment that Catalonia suffered in 2009.

We must keep in mind, though, that the fall of one sector is always accompanied by the deterioration of the others, which, in one way or another, are related.

Therefore, it is very direct and easy to say that, at least, we are in a scenario of economic crisis of the same intensity as in 2009.

However, the 8% drop in employment that took place in 2009 did not come only from the construction sector, which lost some 150,000 workers between 2008 and 2010, approximately 50% of the drop in total employment. Rather, it had an impact on various sectors of the economy, and it was felt in services and also in industry.

This means that, due to the effect of communicating vessels, a drop in employment can also be expected in other sectors, yet to be quantified, mainly in other services, construction and industry.

So a massive economic impact of covid19 on Catalan retail & commercial services would imply a massive impact on Catalan economy as well.

Business minimum burnout calculation model

From the data of real businesses used in this report, we have derived an estimate of what could be the approximate minimum of opening costs of a Catalan business during a year.

We understand that a serious policy to help the small business should keep these numbers in mind when making decisions about the temporary closure of business and restrictions on its ability to operate.

And, above all, when deciding the public resources that are dedicated to preventing financial disaster and facilitating post-pandemic economic recovery.

To make the calculations, we have assumed the minimum cost of opening the blind for a 100m² establishment and 4 workers, in addition to the entrepreneurial owner of the business.

|

Unit cost (monthly) |

Units |

Total cost |

| Autonomous (business owner) |

1,800 € |

1 |

1,800 € |

| Worker (gross salary) |

1,400 € |

3 |

4,200 € |

| Rent |

1,000 € |

1 |

1,000 € |

| Consumption |

500 € |

1 |

500 € |

| Taxes |

100 € |

1 |

100 € |

| Accountant |

200 € |

1 |

200 € |

| Financial services |

500 € |

1 |

500 € |

|

|

|

|

| Total monthly |

|

|

8,300 € |

| Total year |

|

|

99,600 € |

| Total monthly (salaries not included) |

|

|

4,100 € |

| Total year (salaries not included) |

|

|

49,200 € |

Table of approximate minimum costs that a Catalan establishment of 100m2 and 4 workers must assume when it opens for a month.

From this estimate for a single business, we can assess the total amounts that this supposes if we scale it to whole Catalonia:

| Activity |

Businesses |

Cost monthly |

Cost annually |

Monthly cost

(no salaries) |

Annual cost

(no salaries) |

| Essential |

15,007 |

124,55 M€ |

1,5 Bn€ |

61,5 M € |

738,3 M € |

| Not Essential |

108,858 |

903,5 M€ |

10,8 Bn€ |

446,3 M€ |

5,35 Bn € |

Table of minimum operating costs of retail stores & commercial services per month and per year.

What aid do we need to mitigate the economic impact of covid19 on Catalan retail & commercial services?

With these calculations it is already possible to estimate the amount of a hypothetical minimum aid. An aid sufficient to allow businesses to continue operating and not have to close as a result of not being able to face minimum operating expenses.

In a first “German” hypothesis, we assume that government is concerned and aware of the situation and would be willing to cover up to 100% of the cost of running the business for 12 months. In reality, the German government has covered 70% of the turnover of businesses during the year before the year of losses from the pandemic. Which goes way further than our hypotheses. But this is Spain, and Spain is the EU state that has allocated the least resources to direct aid to small businesses during the pandemic. According to the European Central Bank, Spain has allocated 1.3% of GDP to direct aid, far from the average of 4% of GDP in the rest of the EU states.

Thus, we have:

| “German” aid |

|

| Coverage |

100% |

| Months |

12 |

| Total monthly (per unit) |

8,300 € |

| Total period (per unit) |

99,600 € |

| Total period |

10,84 Bn € |

| Total monthly (per unit, no salaries) |

4,100 € |

| Total period (per unit, no salaries) |

49,200 € |

| Total period (no salaries) |

5,35 Bn € |

In this hypotheses we assume that 100% of the workers were temporary covered by the Spanish social security unemployment insurance.

This implies that Spanish government should allocate between 5 and 6 Bn € in 2021 to cover the rest of the aid.

In other words, in order to provide a minimal financial coverage and thus avoid massive business closures, the state should allocate, at least, between 10 and 11 Bn € to aid small businesses.

Otherwise, the economic impact of covid19 on Catalan retail & commercial services would fulfill the most pessimistic expectations.

References

Proceedings of the National Academy of Sciences of the United States of America: Rationing social contact during the COVID-19 pandemic: Transmission risk and social benefits of US locations | Authors: Dr. Seth G. Benzell, Avinash Collis, Christos Nicolaides. | Publication: Pnas.org

MIT News: “Which businesses should be open?” | Author: Peter Dizikes | Publication: News.mit.edu

How to predict covid19 impact on urban retail | Author: David Nogué | Publication: Geoawesomeness.com

Covid19 Impact on Barcelona Retail | Author: David Nogué | Publication: Geoawesomeness.com

Covid-19 Impact on Manhattan Retail | Author: David Nogué | Publication: Geoawesomeness.com

London Retail Covid19 Impact | Author: David Nogué | Publication: Geoawesomeness.com

Impacto do Covid19 no varejo paulista (Conferència) |Presentation in São Paulo.

Ocupació comercial de les ciutats catalanes (IATC) | Author: Eixos.cat | Publication: Gencat.cat

Espanya és el país que menys ajudes directes ha donat per la coronacrisi, segons el BCE | Author: Corporació Catalana de Mitjans Audiovisuals | Publication: ccma.cat